Archives for: October 13th, 2017

Buyers circle new listings like hungry wolves, plucking choice morsels from a skeletal inventory.

“For every house that comes on the market you have four or five buyers waiting for it,” said Frank Wilson, with John L. Scott in Poulsbo. “As fast as they come on, they’re sucked right back off.”

Written by andrea on October 13, 2017

The median price for homes sold in Kitsap County reached $285,000 last month, as sales activity ramped up and inventory remained low.

Written by andrea on October 13, 2017

The U.S. homeownership rate fell to the lowest in more than 50 years as rising prices put buying out of reach for many renters.

The share of Americans who own their homes was 62.9% in the second quarter, the lowest since 1965, according to a U.S. Census Bureau report Thursday. It was the second straight quarterly decrease, down from 63.5% in the previous three months.

Written by andrea on October 13, 2017

After drifting higher for nearly a month, mortgage rates retreated this week but remain within a tight band.

As the markets calmed, home loan rates stabilized. With several key economic reports coming up, volatility could return. An unexpected global event would also cause a jolt to rates. But it seems more likely that they will continue to hover about where they are.

Written by andrea on October 13, 2017

Mortgage credit continues to tighten

The U.S. economy may be on the upswing, but your chances of securing a mortgage are not.

Written by andrea on October 13, 2017

Mortgage rates moved solidly higher last week, but lenders saw no letup in loan demand.

Mortgage application volume rose 4 percent from the previous week. The Mortgage Bankers Association included an adjustment for the Martin Luther King Day holiday. Volume continues to lag last year, however, by 18 percent, mostly due to the falloff in loan refinances since rates shot up after the presidential election.

Written by andrea on October 13, 2017

Overall housing production declined in January after an unusually robust reading in the multifamily sector in December, but economists were unfazed. “As we move forward in 2017, we can expect the multifamily sector to continue to stabilize and single-family production to move forward at a gradual but consistent pace,” says Robert Dietz, chief economist for the National Association of Home Builders.

Written by andrea on October 13, 2017

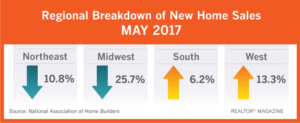

The median price for a new single-family home reached a record high in May of $345,800, the Commerce Department reports. Buyers will be paying a huge premium for new construction, as new-home prices are now 16.8 percent higher than they were a year ago.

Written by andrea on October 13, 2017

The digital world is slowly creeping its way into mortgages, as more lenders start to unveil digital mortgage applications and boast a fully online digital mortgages.

Written by andrea on October 5, 2017

PORT ORCHARD – Newly adopted city design standards for new and modified single family residences, duplexes and residential fences can be on the City of Port Orchard’s website.

Written by andrea on October 5, 2017