What is Fraud and How to Avoid It

Halloween is almost here and there’s more out there than just ghouls, ghosts, and zombies! Fraudsters are the real-life spooky characters we hope you only ever read about. At Pacific Northwest Title, we take this threat very seriously and believe that one of the first steps in preventing fraud is education, so we’re here to answer your questions using resources from the FBI’s website and their 2021 Internet Crime Report (2021_IC3Report).

What exactly is fraud?

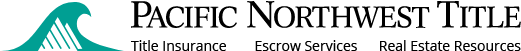

Fraud is a broad term that encompasses several types of wrongful or criminal behavior, all of which involve stealing from or deceiving others to gain a personal or financial benefit. Unfortunately, fraud is on the rise. According to the Federal Bureau of Investigation’s Internet Crime Report, the amount of money victims lost from 2020 to 2021 rose by $1.37 million. That’s a substantial increase!

How do they do it?

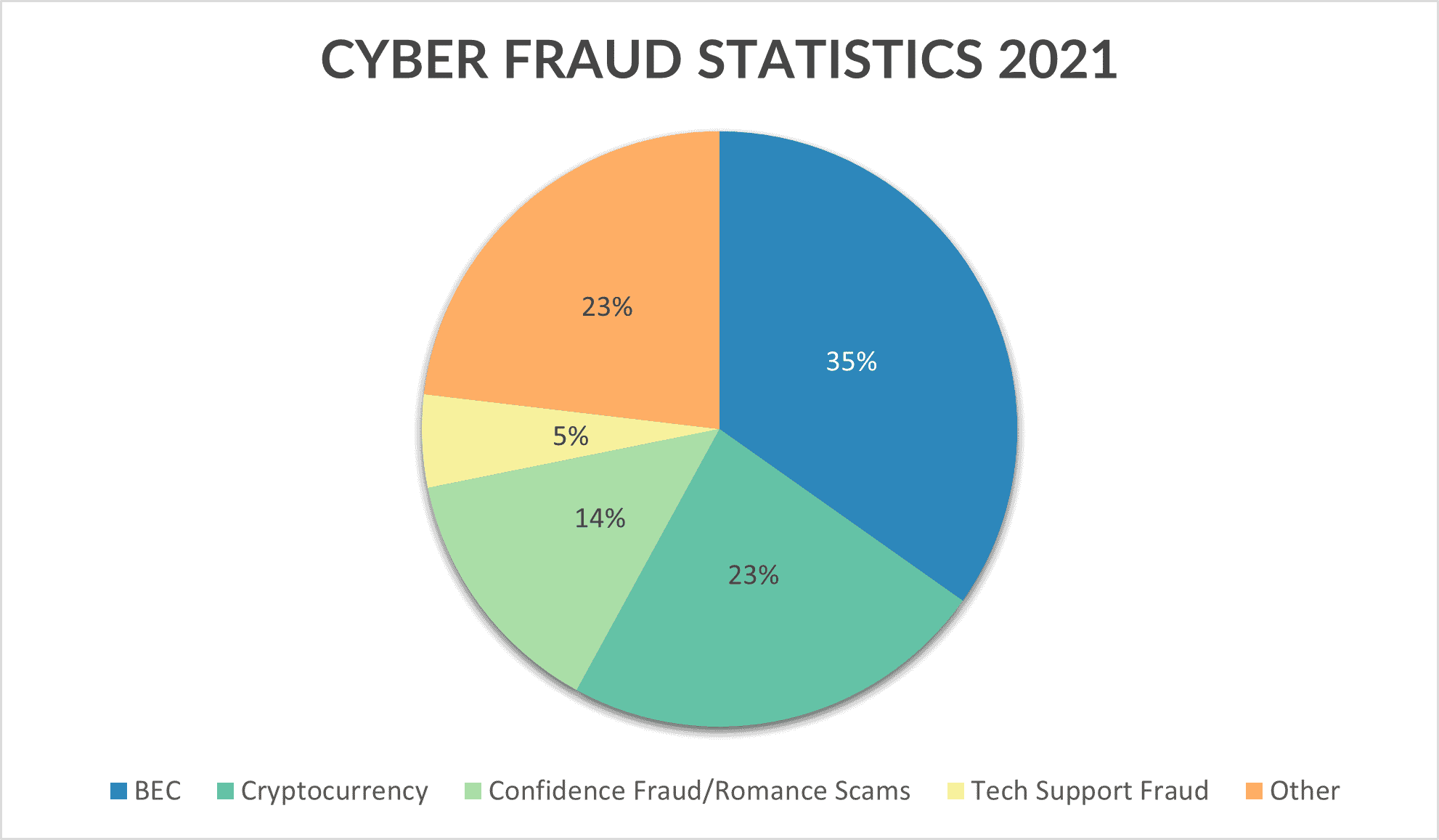

There are multiple ways that criminals trick individuals into losing money, but Business Email Compromise (BEC) is decidedly one of the most common and expensive ways. Fraudsters take advantage of people’s dependency on using emails for professional and business ventures. From the FBI’s website, “In a BEC scam, criminals send an email message that appears to come from a known source making a legitimate request.”

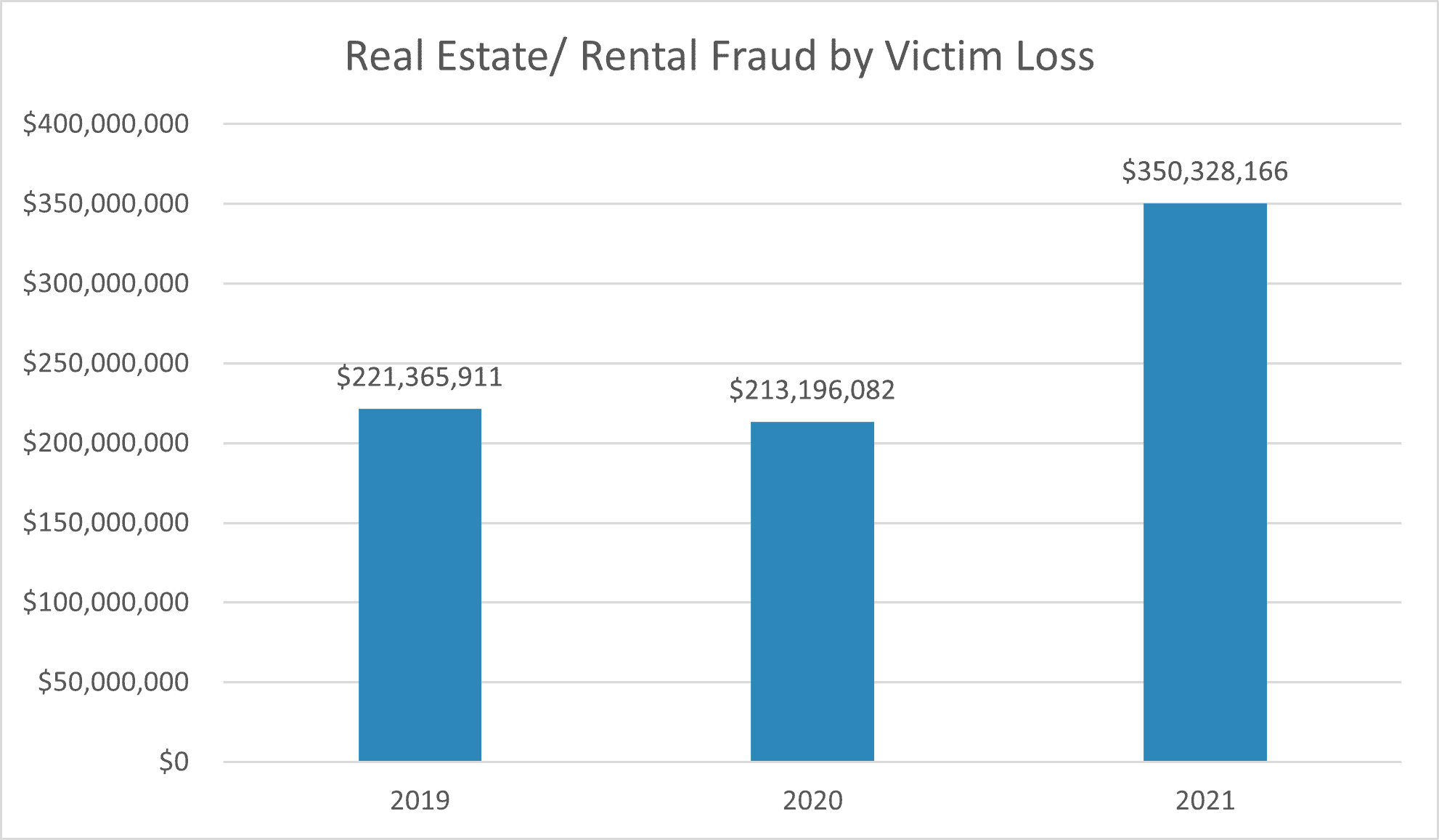

These scams account for 35% of all cybercrimes and the numbers continuously elevate. In 2021, BEC cost victims $2.4 billion, which was over a half a billion dollars more than the previous year. BEC is no joke. In the real estate world, criminals often use the tactics of BEC to commit wire fraud.

One of the common ways in which BEC is occurs is when a scammer “spoof[s] an email account” by very subtly changing a legitimate email address. For example, switching johnsmith7174@madeupcompany.com to johnsmith7I74@madeupcompany.com, which changes the number “1” to the letter “I”. If someone wasn’t looking closely, it would be easy to overlook the change in address and follow fraudulent wire transfer instructions from an incorrect email address that looks proper.

Another example of BEC is phishing, which saw a 110% increase from 2019-2020. More specifically, spear-phishing is another cyber technique a fraudster uses to trick a victim into sending sensitive information by appearing to be someone they trust. They may send an email pretending to be someone the victim knows, requesting information like wire account details and social security numbers. These messages are often personalized to an individual, so they may seem more mundane or trustworthy.

Other BEC red flags involve creating a sense of urgency or atypical wording, formatting, and spelling. Fraudsters will often pressure someone to act immediately to avoid dire consequences, creating a sense of false urgency. Emails may also appear strange, not having the usual written cadence and dialogue of a known sender. In both instances, taking it slow and verifying everything with your real estate agent or title company is important.

How does Washington state compare to the rest of the United States?

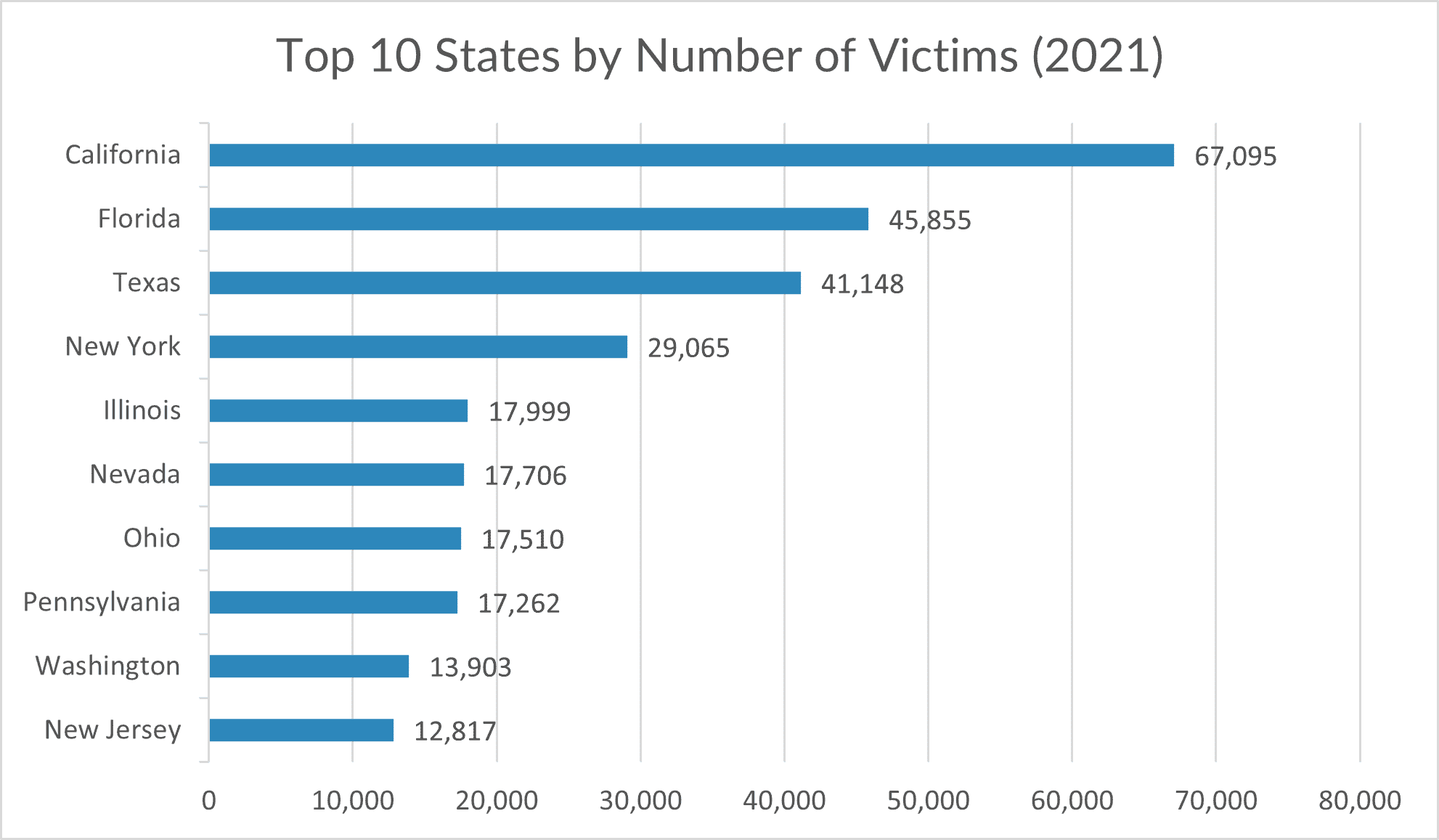

As far as cyber fraud goes, in 2021 we were ranked number 9 in the country based off number of victims for a total of 13,903 total. We also ranked number 10 for the total amount those victims lost, coming in at nearly $1.6 million.

How do I protect myself?

Luckily, it’s not all doom and gloom! There are actions that you can take to avoid wire fraud and stay safe. Follow these 5 tips to keep the frauds out of your transactions!

- CALL, DON’T EMAIL. Confirm all wiring instructions by phone before transferring funds. Use the phone number from the title company’s website or a business card.

- BE SUSPICIOUS. It’s not common for title companies to change wiring instructions and payment information.

- CONFIRM EVERYTHING. Ask your bank to confirm the account number and the name on the account before sending a wire.

- VERIFY IMMEDIATELY. Call the title company or real estate agent to validate that the funds were received. Detecting that you sent the money to the wrong account within 24 hours gives you the best chance of recovering your money.

- FORWARD, DON’T REPLY. When responding to an email, hit forward instead of reply and type the person’s email address. Since criminals may use an email address that is very similar to the real one for a company, this extra step will make it easier to discover if a fraudster is after you.

For more tips on how to protect yourself from BEC, check out this article from the FBI’s website.

What are we doing at PNWT to protect you?

Pacific Northwest Title takes your safety and security seriously and are proactive in providing the best defenses available. By using CertifID, you are helping to protect your money. It’s an easy-to-use software solution that enables us to verify customers identities so that they can confidently transfer funds.

So how does it work? Simple!

- First, they will validate your mobile device by using two-factor authentication

- Next, they will ask you a few questions that will help them identify you

- Last, they’ll ask you to enter your bank account and routing details

That’s it! This enhanced digital security helps you to rest easy so that you can sleep well this Halloween!